Payroll

Overview

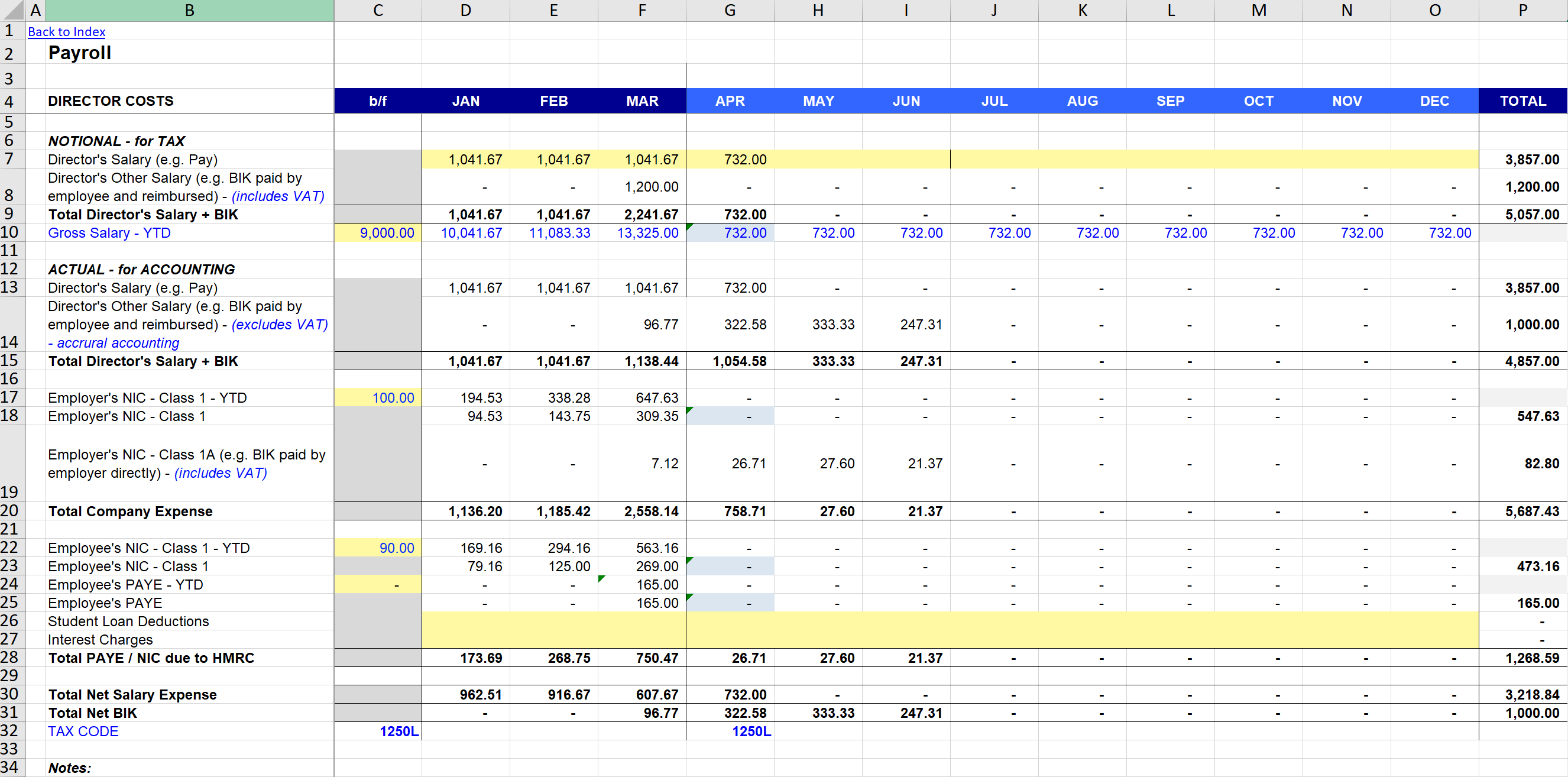

This is quite a complex tab that shows all the Salary Payments due, to the Company Director and then H.M.R.C. Tax, and N.I.C.s payments due to H.M.R.C..

Click to view large-sized image

The yellow pastel coloured cells are where any input data should be recorded. The figures shown in the other cells are generated from the formulae that have been created.

Starting from the top:

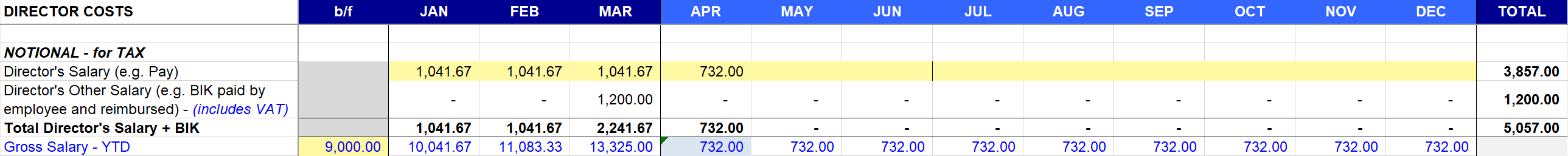

Notional for Tax

Click to view large-sized image

Director’s Salary:

This is where you should record the Gross Monthly Salary paid to the Director (shown in the yellow line above). When you record this year, it will then show up as an expense in the ‘Profit & Loss’ Tab.

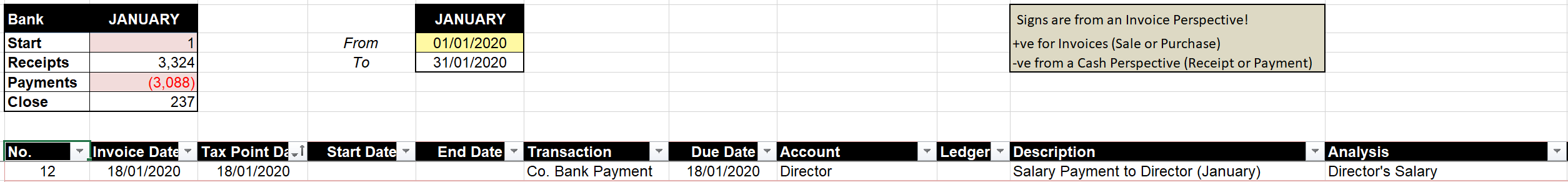

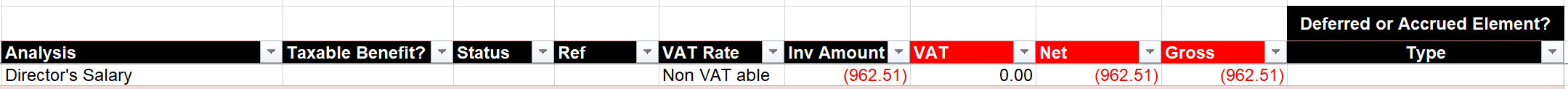

When the Director is actually paid his or her Net Salary, this Cash Payment Transaction is recorded in the relevant ‘Monthly Transaction’ Tab, as shown below, for January:

Click to view large-sized image

Click to view large-sized image

Director’s Other Salary:

If there are any costs for services of goods, paid by an Employee (e.g. Director), which are later re-imbursed to the Director by the Company, which are considered to be Taxable Benefits (e.g. Benefits in Kind - B.I.K.), then these will appear in this line.

The cost of the expense, however, from a P.A.Y.E. / Payroll Tax perspective, will not be spread over time.

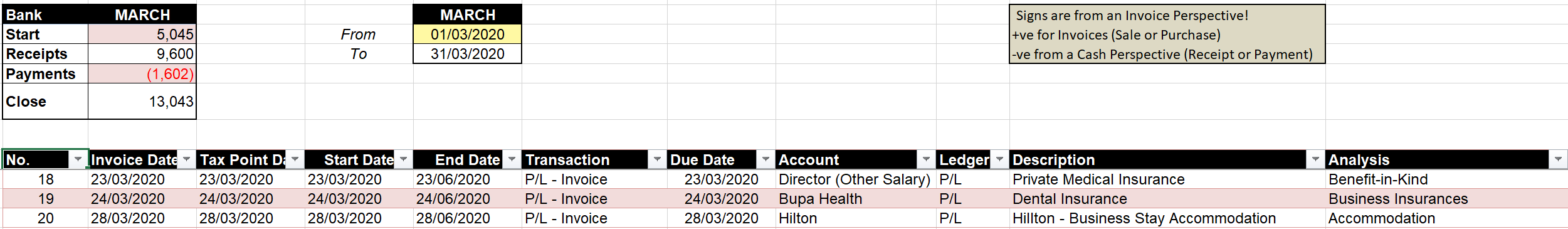

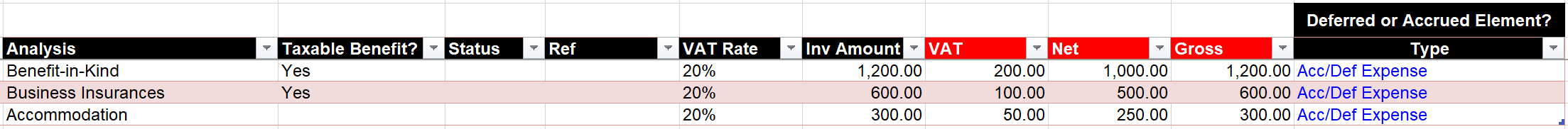

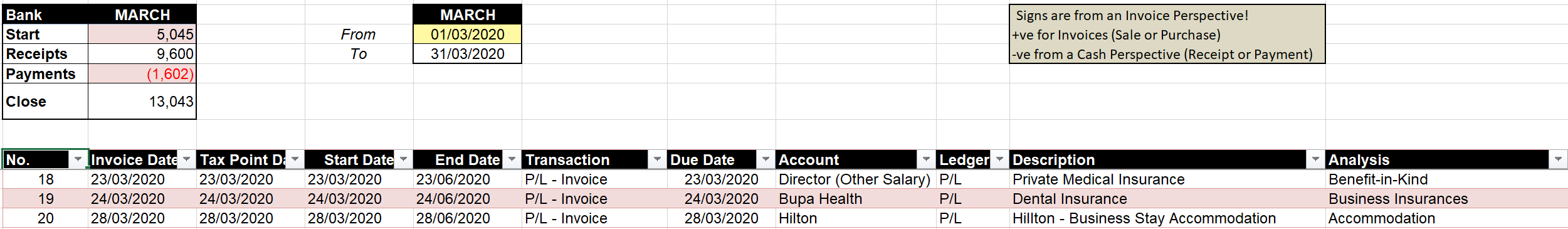

For example, the figure of £1,200 shown below, arises from the following transaction that was recorded in March.

Click to view large-sized image

Click to view large-sized image

Private Medical Insurance, for 3 months, was paid for by the Director personally. An invoice (or expense receipt) was then raised by the Director and sent to the company on the 23rd of March.

As Private Medical Insurance is considered as a Taxable Benefit, and because the Insurance was both arranged and paid for by the Director (then later re-imbursed by the Company), it should be considered by the Company as Other Earnings to that Director.

This is why the amount of £1,200 appears against the line called Director’s Other Salary, in the Payroll Tab (see top of Page). According to H.M.R.C., a B.I.K. is N.I.C./P.A.Y.E. chargeable on its Gross Amount, and why the Gross Amount of £1,200, and not £1,000 is shown.

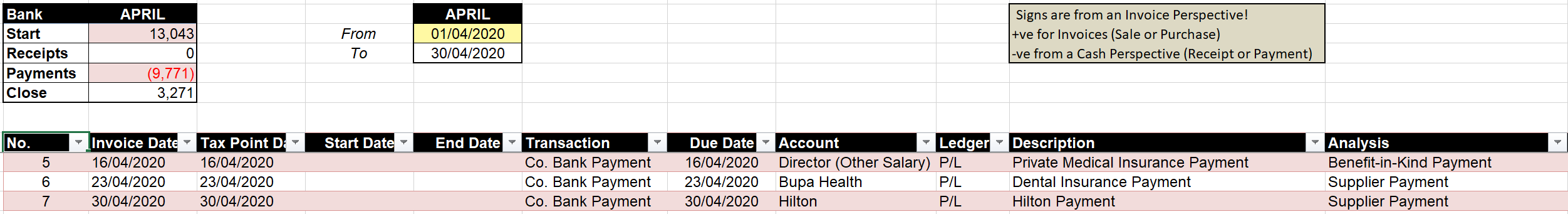

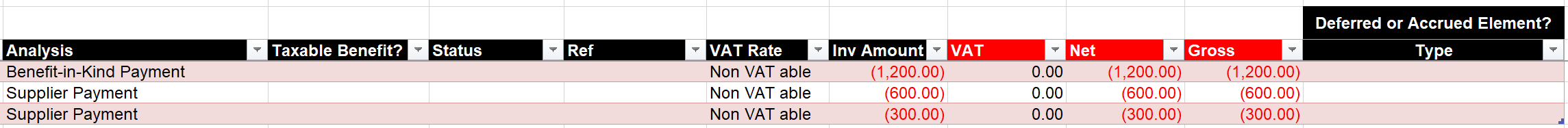

Note, the re-bursement to the Director of this amount can be seen in April Monthly Transaction Tab, as shown in the picture below:

Click to view large-sized image

Click to view large-sized image

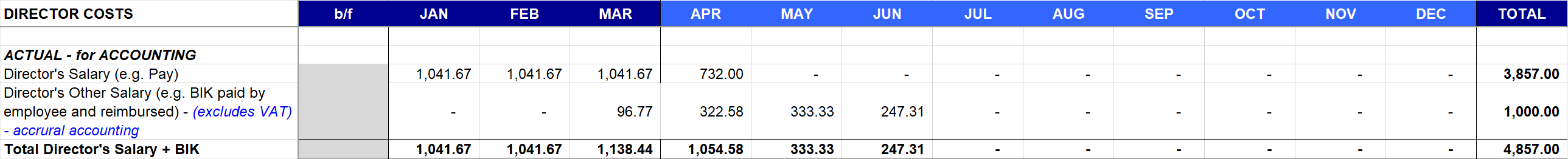

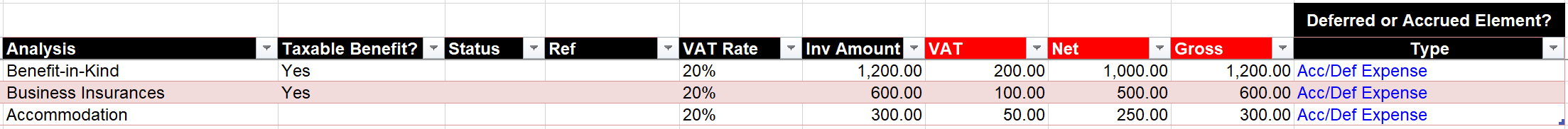

Actual for Accounting

The next table shows the same picture, but with the cost of the Private Medical Insurance spread over the relevant period:

Click to view large-sized image

As the Medical Insurance covers three months, the cost is spread over that time, from: the 23rd March to the 23rd June. Also, as V.A.T. is likely to be recoverable from H.M.R.C., the cost to the company of paying for this benefit, should just total to £1,000 - not £1,200 (as we assume that £200 can be claimed back from H.M.R.C.), which we can see it does from the above Picture.

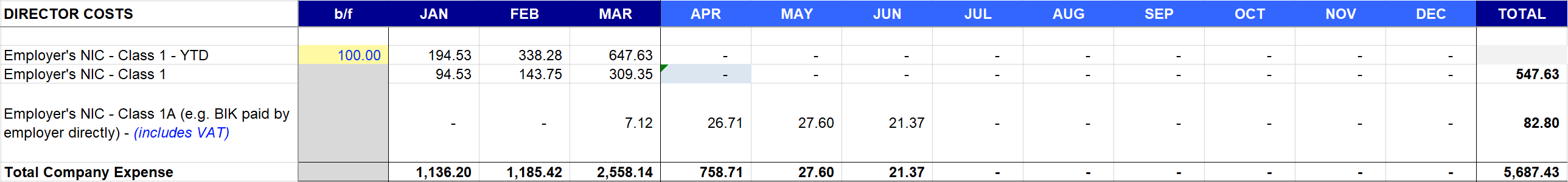

Employer’s N.I.C.s

This section calculates what Employer’s N.I.C. are due.

Click to view large-sized image

Class 1 NIC is calculated from the line ‘Total Director’s Salary + BIK’, in the Notional – for TAX section. This is done in the usual way – by first calculating the Y.T.D. amount, and then from that, the monthly charge.

The Class 1A expense shown (of £82.80) arises from a completely separate transaction: in March, the company had arranged directly for Dental Insurance for the Director, of £600 Gross. Though this is not considered as Director’s Other Salary (as the company made all the arrangements), extra Class 1A NICs is still due (according to our interpretation of the H.M.R.C. rules)

Click to view large-sized image

Click to view large-sized image

Therefore £600 (Gross figure) * 13.8% = £82.8 in Class 1A is due, which is what is shown in the payroll line above (as the total figure).

Here we have assumed that, even though the Class 1A is calculated on the Gross figure, that unlike the Class 1 N.I.C. charged on the other B.I.K. example above (in the Private Medical Insurance), that here the Class 1A charge can be spread over the period over which the Dental Insurance expense relates to.

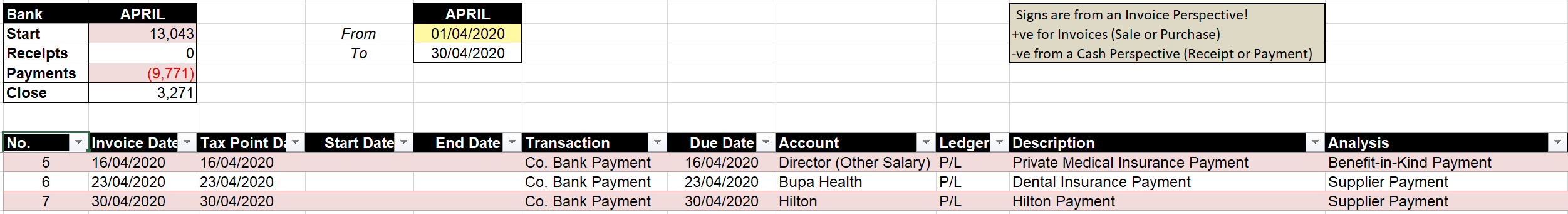

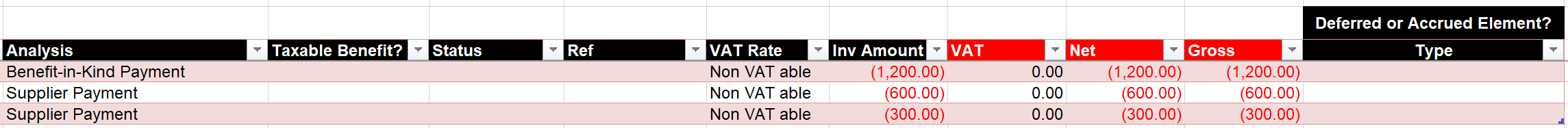

Note the company later, in April, does settle directly with BUPA Health, the Dental Insurance, as shown in the second cash transaction below:

Click to view large-sized image

Click to view large-sized image

Info:

The Hilton Transaction, (the third transaction shown in the examples above) was a cost paid by the company to allow the Director to stay in accommodation, when on Business Travel. As the stay was purely business related, it is not considered as a Benefit in Kind, and therefore has no effect on how much N.I.C. / P.A.Y.E. should be paid. Instead, it is treated, and accounted for, as a normal business expense (i.e. raising of a supplier invoice in March, and payment to supplier in April).

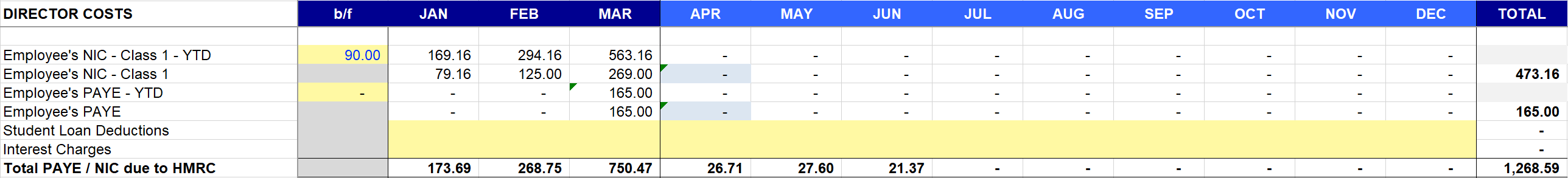

P.A.Y.E. and Employee’s N.I.C.s

This section calculates the P.A.Y.E and Employee’s N.I.C. that is due:

Click to view large-sized image

Both are calculated from the line: ‘Total Director’s Salary + BIK’, from the total amount in the Notional – for TAX section above.

Student Load Deductions and Interest Charges can be optionally entered, depending on how the deductions are made.

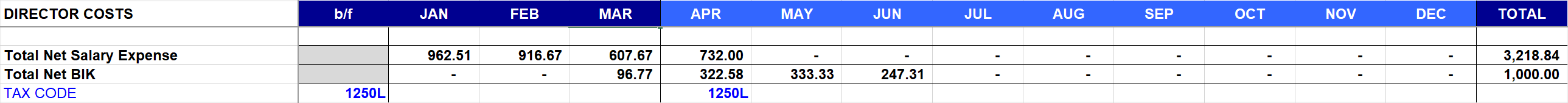

Net Director Salary Costs

Final Net Director Salary Costs (both normal salary, and any other B.I.K.s) are shown as the last two lines. These are calculated from the section: Notional – for Accounting, and are after deducting Employee’s N.I.C.s and P.A.Y.E. (which are calculated from the section: Notional – for Tax)

Click to view large-sized image

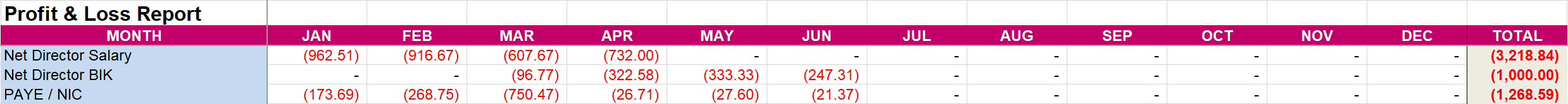

All three lines: Director Salary, Director B.I.K. (Other salary), and P.A.Y.E./N.I.C. expenses, should appear in the Profit & Loss page, as shown here:

Click to view large-sized image

Extra Filings

Info: In addtion to the above payroll book-keeping, whenever you make a payroll payment (or dividend payment) - there are some extra documents that you need to fill in and submit:

-

Salary payments - submission of a monthly E.P.S. / F.P.S. to HMRC.

-

Dividend payments - confirmation of the issuance of dividends should be recorded in minutes. A dividend voucher should then also be kept.

More information

You can find out more about required submissions and records, and how to make them, here:

Feedback

Submit and view feedback