Goodwill

Goodwill Calculation

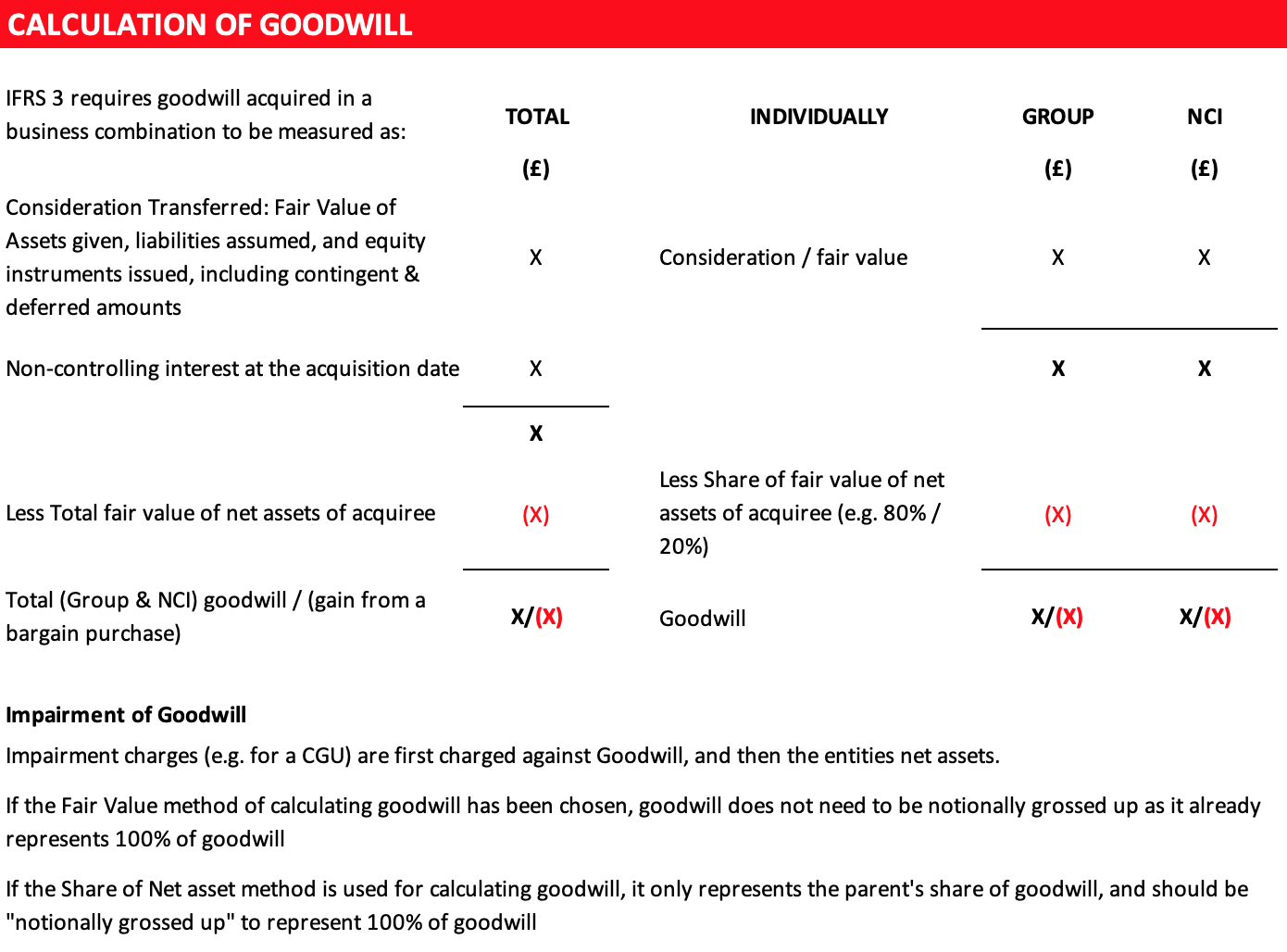

Under IFRS 3, Goodwill should be calculated as follows:

Gain in Bargain Purchase

If the difference above is negative, the resulting gain is a bargain purchase in profit or loss, which may arise in circumstances such as a forced seller acting under compulsion. However, before any bargain purchase gain is recognised in profit or loss, the acquirer is required to undertake a review to ensure the identification of assets and liabilities is complete, and that measurements appropriately reflect consideration of all available information.

Non-controlling Interest

The non-controlling (minority) interest is measured at acquisition, and can be measured at either: fair value, or the NCI’s proportionate share of the fair value of the net assets of the acquiree.

The choice in accounting policy applies only to present ownership interests in the acquiree that entitle holders to a proportionate share of the entity’s net assets in the event of a liquidation.

Example

P pays 800 to acquire an 80% interest in the ordinary shares of S. The aggregated fair value of 100% of S’s identifiable assets and liabilities (determined in accordance with the requirements of IFRS 3) is 600, and the fair value of the non-controlling interest (the remaining 20% holding of ordinary shares) is 185.

The measurement of the non-controlling interest, and its resultant impacts on the determination of goodwill, under each option is illustrated below:

| NCI based on fair value | NCI based on net assets | |

|---|---|---|

| Consideration transferred | 800 | 800 |

| Non-controlling interest | 185 | 185 |

| Total | 985 | 920 |

| Net assets | (600) | (600) |

| Goodwill | 385 | 320 |

Feedback

Submit and view feedback